US Crypto Policy: Trump's GENIUS Act and the Coming Regulatory Thunderdome

Oh, boy. Here we go again. Another round of crypto hype, another batch of "experts" telling us this time it's different. Gimme a break. This whole "US crypto policy" thing under the Trump administration… it's like watching a toddler play with a chainsaw. Sure, they think they know what they're doing, but the potential for disaster is, shall we say, high.

Trump's "GENIUS" Act: A Critical Examination

So, Trump passed the "GENIUS Act" for stablecoin regulation, huh? According to TRM Labs, this is "landmark progress." Right. Let's be real, any bill with a name that self-congratulatory is probably hiding something nasty.

What's the catch? Well, for starters, federal regulators have until July 2026 to issue regulations, and the act doesn't even take effect until 2027 – or 120 days after those regulations drop. So, basically, we're talking about something that might happen, maybe, in a few years. That's an eternity in crypto time. By then, we'll all be living in the metaverse, or enslaved by DogeCoin overlords.

And don't even get me started on the acronym. GENIUS? Seriously? It stands for something about "Guaranteeing, Ensuring, and Nurturing Innovation in the United States." Bet they spent weeks workshopping that gem.

The Illusion of Regulatory Clarity

The TRM Labs report also crows about "regulatory clarity" fueling institutional adoption. Okay, but clarity for whom? For the big banks and hedge funds who can afford armies of lawyers to navigate this crap? What about the average Joe who just wants to dabble in crypto without getting rekt? Are they gonna understand this Byzantine regulatory landscape? I doubt it.

And speaking of institutions, the Basel Committee is already reassessing its proposed rules for banks' crypto exposure because the US and UK are balking? So much for global consistency and co-ordination. More like a global game of chicken, where the average investor is strapped to the front of the car.

Oh, and because Washington can't ever get its act together, the SEC and CFTC are still fighting over who gets to regulate what. Like a bunch of dogs fighting over a bone while the house burns down.

You know what REALLY grinds my gears? The sheer volume of reports, consultations, and "frameworks" that come out of these regulatory bodies. It's like they're trying to bury us in paperwork so we won't notice they're not actually doing anything. I swear, if I have to read one more "discussion paper" on crypto market abuse, I'm gonna scream. And offcourse, none of this tackles the real problem: scammers and rug pulls.

"Innovation-Friendly Regulation": A Double-Edged Sword

The report keeps using the phrase "innovation-friendly regulation." Which, let's be honest, is code for "lightly regulated." And lightly regulated means ripe for exploitation. Remember the North Korea Bybit hack where they stole over $1.5 billion? Yeah, that happened because crypto is still the Wild West, even with all these new rules.

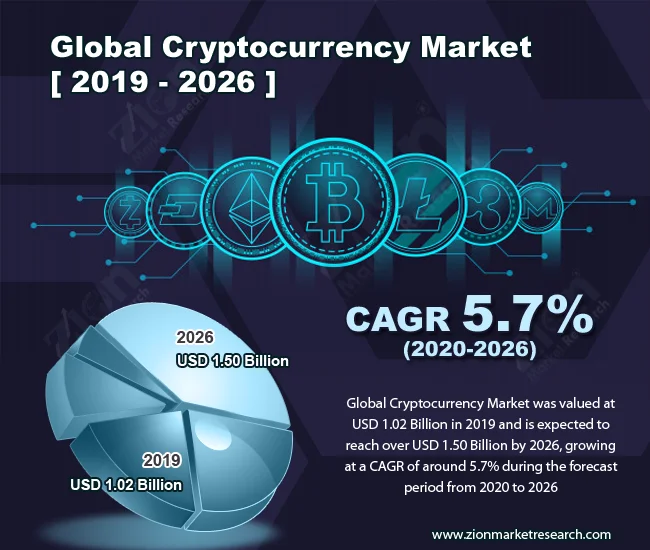

And it's not just North Korea. The EU is slapping sanctions on Russian crypto exchanges like Garantex. But guess what? The bad guys are always one step ahead. They'll just find a new loophole, a new jurisdiction, a new way to launder their ill-gotten gains. According to a recent Crypto Market Update: Strategy Faces MSCI Index Removal, SEC Freezes Ultra-Leveraged ETF Approvals, regulatory uncertainty continues to impact the cryptocurrency market.

Which brings me to the EU, which is implementing MiCA, and, according to the report, is already seeing "major differences in how crypto markets are being supervised by national authorities." Shocker. So, now we'll have a patchwork of regulations across Europe, creating even more opportunities for regulatory arbitrage.

The Underlying Problem: A Critical Summary

Look, I'm not saying crypto is inherently evil. But this whole "regulatory clarity" narrative is a load of BS. It's just a way for the powers that be to pretend they're doing something while the sharks continue to circle. The GENIUS Act? More like the "Guaranteed Enrichment of the Notorious, Inept, and Unscrupulous Scheme."

And honestly… maybe I'm just being cynical. Maybe this time is different. Maybe these new regulations will protect investors and foster innovation.

Nah. Who am I kidding?